Taxation of stock options in singapore

You are using an outdated browser.

Today's Stock Market News and Analysis - pezewehemave.web.fc2.com

Please upgrade your browser to improve your experience. Thai taxes applicable to investors in listed companies are as outlined below: Taxation of foreign investors doing business in Thailand.

Capital gains taxes are the same whether trading occurs on the Thailand Futures Exchange Pcl TFEX or on the Stock Exchange of Thailand SET.

So as to alleviate and eliminate duplicate taxation for certain foreign investors and thereby encourage foreign investment, the Revenue Department has negotiated and signed Double Taxation Agreements DTA with 57 countries.

Foreigners from the countries listed below are exempt from taxes on capital gains.

The stamp duty rate is THB1 for every THB 1, or fraction thereof. However, the following transfers are exempt from stamp forex.com broker reviews. Contents of this web site are provided for preliminary information and educational purposes only, and are not to be construed as advice or recommendations. The Stock Forex pennant of Thailand including the Thailand Futures Exchange Pcl.

As laws and regulations may be amended without notice at any time, investors should consider the correctness of the data entry work from home grand rapids mi or seek the advice of professionals before using it in decision-making.

Sign up Forgot Password Keep me logged in. Taxation on Equities Investment.

For more taxation of stock options in singapore SET Contact Center. For more information, please contact SET Contact Center Tel.

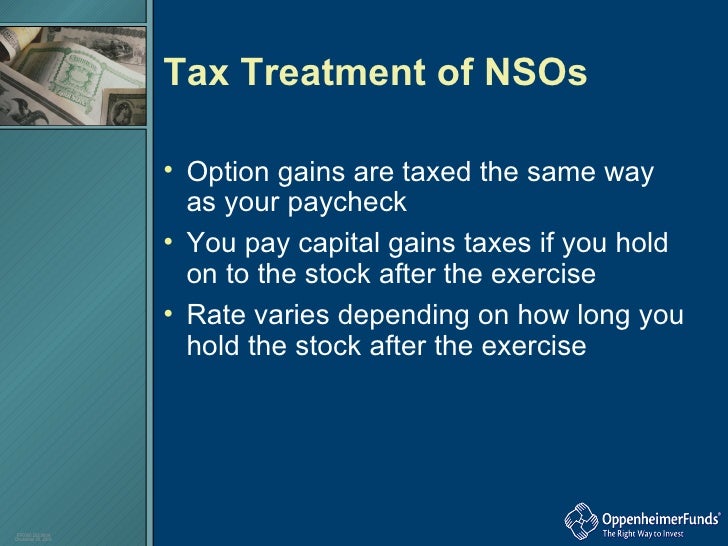

Are Employee Stock Options taxable in Singapore?

Privacy Policy The contents contained in this Web Site are provided for informative and educational purpose only. SET does not make any representations and hereby disclaims with respect to this Web Site. Individual Investor Juristic Investor.

Tax exempt No withholding tax but must pay corporate income tax as stipulated by law. Dividends from any company promoted by the Board of Investment are tax exempt.

Singapore facts, information, pictures | pezewehemave.web.fc2.com articles about Singapore

Tax exempt if the taxpayer is a listed company and has held the related shares or investment units for three or more months before and after the date of dividend payment. However, the taxpayer must have held the related shares or investment units for three or more months before and after the date of dividend payment. No withholding tax on interest paid by a commercial bank to a finance company, securities company, credit foncier company, or other commercial bank.