Private equity secondary market valuation analysis

I have a 2nd round interview coming up with a secondary PE fund. They do mostly LP secondaries of funds that are majority invested. I'm still trying to understand exactly how they value these LP interests. In the round 1 interview, they told me that they do a bottoms up analysis on the underlying portfolio companies, and then assume a rate of return on the unfunded portion, which dilutes the value.

Can someone explain this in some more detail? What exactly goes into the bottoms up analysis? Does this mean modeling each company with an LBO , assuming a target IRR for the entire portfolio, and backing into a purchase price for each company, then summing them up? Do they use only equity for the purchase since the portfolio companies will already have debt? If anyone can explain the mechanics in more detail or perhaps even have a sample model to share, that would be greatly appreciated.

I know how to do a normal paper LBO but not sure what to expect on this one. Only slightly related, not really an answer to your question, but you may find this interesting assuming you haven't already watched it: They're buying LP interests, so think of it as shares of a stock.

I don't work in secondaries, but I'm guessing it's something like: To the unfunded commitments. To value the equity you would use traditional methods -- DCF , comps , LBO , etc Think of it as doing a "mini model" for each of the companies in the fund. Build out a comp set, grow sales, expand margins, pay down debt, etc.. Then combine all those cash flows and remove carry and management fees. Those are the cash flows the fund gets from selling the existing companies.

Then apply a return to the unfunded; 1. These unfunded net returns would be 1. Unfunded only dilutes the value if your required return is above the net return from the unfunded; for example if you want to return 1.

Now determine what you'd pay for that. Secondary firms tend to start at 1. Most PE funds can't even return that in a 7-year life anymore, and most are sitting on too much cash.

Also, in terms of a case study; I'd be less concerned on modeling the individual companies.

You're expected to know that already. They probably want to see if you can think within a secondary mind-set. Ask yourself questions like, how unfunded is the fund and what does that mean for the risk profile, what vintage is the fund, how levered are the companies in the portfolio, how risky is a buying a venture fund vs. You're telling me that PE doesn't return 1. These are mid single digit net IRR returns, quite low for PE.

You said you don't work in Secondaries, so stop "guessing" and throwing ridiculous statements around. I don't work in secondaries, but I do work in PE and we do track our competitors. And just to prove I get there may be a J-curve effect though being able to buy at the trough of the recession is a big advantage , even ''05 vintage funds are only around 1. I understand the math; I question the soundness of what is supposed to be a "conservative" assumption.

You're assuming an average to above-average return on capital for capital that hasn't been and may never be called. But hey, I get it - just like us, you probably have a lot of money to put to work and principals who want to do deals, so you rationalize them. I would imagine that those quoted MOICs are net and are an average across all buyout funds I could be wrong though. You just proved my point, ''05 vintage funds are on average a 1.

I'm not sure I follow your point on whether or not it gets called? Unfunded returns tend to be either return neutral or dilutive, so if it doesnt actually get called, then the Secondary returns will be even better. Check out some data which I know you have, but for others: Blackstone V was in shambles during the recession and has recovered to 1.

I'd suspect it gets to 1. I'd say that's a pretty solid low case for investments that were made at the height of the bubble. Now there are obviously some real dogs on that list, and I wouldn't recommend putting a full unfunded multiple on them. This did not make sense to me either. How do you use multiples you said 1.

This is the distribution that gets paid to the fund. You do this for each company. DCF is almost never used. Your investor will not want lower on either. So if you have a fund that returns everything next year, generating a ridiculously high IRR but a 1. Or a longer duration deal generates a 1. Secondaries are unique in that you're buying pretty mature assets, so the IRRs tend to be pretty high; but without a solid multiple to go with it, its a tough investment.

IRR almost always clears the hurdle, so focus tends to be on the multiple. Thanks again man - I think this is the most informative thread about secondaries so you're doing the whole community here on WSO a service.

By the way, how does a secondaries firm project out the growth and make all assumptions about these portfolio companies in the first place?

Do they receive portfolio-company level information from the GP or from the selling LP? I don't understand how you get a ridiculously high IRR in general with a low multiple, because isn't the multiple calculated off of what the secondaries firm pays? The IRR and the multiple are not mutually exclusive. Do they discount each portfolio company by the appropriate discount rate given the level of riskiness for the company, and then sum up those NPVs as their offer price? PE has come a long way in the last 5 years in terms of reporting standards.

A couple of years of sub-par returns made the industry a whole lot more LP friendly; its pretty rare now for a GP not to produce quarterly one page summaries on each company. These will have all historical information and sometimes includes next years projections.

The mega buyout funds in particular provide loads of company data for you to use. In terms of projecting growth, you can look at public comp projections, historical trends, GP commentary, etc Management fees are charge on commitments for the first 6 years investment period , and net cost thereafter cost basis of current investments If they charged on NAV then GPs would write everything up and generate more fess Calculated net cost should be pretty straight forward.

Move these around to certain extremes and you can see what I mean. This is certainly meaningful if there is one large company that the GP says will be sold next quarter. Say for example company A is highly risky and you want to get paid 2x, while company B is fairly straight forward and you want to get paid 1. Weight those on amount of total distributions to generate your fund required return. But in terms of the actual methodology, it tends to be all distributions, then apply the 1.

This last piece is important because it means you have to assess how "fair" the GP's NAV is. All seller's want par, but if the fund in question is written up to crazy levels by the GP, it'll be impossible.

Conversely, if a GP is very conservative, you can pay premiums all day and still generate a nice return. This last piece will come up in a case study, so make sure you understand it. So to summarize, this is how you would value a secondaries position? Correct me if I missed anything. The actual dollar amount for the LP interest will be whatever percentage the LP owns in the fund multiplied by the aggregate value you got in step 3.

You will have entire future cash flow distribution on a FUND basis. When an LP sells its interest, it will sell based on a record date NAV Q1-Q4 , and usually deal process could take months after submitting bid, signing and legal transfer.

In the mean time, the old LP has already paid new capital commitment and received distribution between Record Date and Legal transfer date.

I don't think the modeling test will go details into overall deal structuring leverage, deferred payment, upside sharing etc etc but it will be good to know those. Without repeating answers that were already made, in regards to 3, you don't add the unfunded portion to your purchase price. Its implied that you will fund these contributions going forward, but you aren't paying for them today. Purchase price is only paying for NAV today, you can't directly discount unfunded as future contributions are 1: Also, NAV includes not only the portfolio company value, but any fund balance sheet items such as cash, prepaid management fees, or fund level debt.

Ok I understand that you're only actually purchasing the NAV today. So if you do not add the unfunded portion to your purchase price, how is that portion expressed, and what do you need to model it out for? An offer letter would simply say that you're paying a purchase price of x for current NAV, and taking on all contractual responsibilities associated with the fund position. Nothing more needs to be said about the unfunded unless the deal involves some more complex structuring.

As a buyer, you need to model it out because it's a real obligation that must be met at some point in the future.

To understand what the deal will return in aggregate, you need an informed expectation as to what return future cash outlays will deliver. Any offer would state in the LOI that you're assuming all unfunded for the position going forward. The reason this needs to be included in the model is because it impacts your returns.

Your returns are comprised of distributions from current companies plus future companies divided by the purchase plus unfunded and fees. Your return on the unfunded is a component of this. You can see in the following equation how you can compensate for "poor" unfunded, unfunded you don't really want since you don't trust the GP's investment judgement.

Since you cant pay less for the unfunded, you reduce the purchase price to help subsidize the poor unfunded returns thus highly unfunded deals with poor managers are very difficult to get done since the price will be very low. Or if you really like the GP and your Unfunded is a 2. In terms of the modeling, say the portfolio has 3 companies, you would model out those 3 companies in their standalone models. Then for each one, assuming an appropriate exit multiple each, and then targeting say 2.

And then sum up what it would be willing to pay for each to get the purchase price for the entire portfolio. Just to clarify the larger picture more, aside from comps mainly, how intensive is the modeling? For the less mature funds, the companies would farther away from their exit years, so in that case, would the pricing of individua l companies be less multiples-based and more dcf based?

Is anyone perhaps m8 or mrb familiar with how they do co-investment modeling? How often do co-investments happen even though PE firms are sitting on a ton of cash, they still might not want to commit too much in these uncertain times?

Also- you said the purchase price is expressed as a percentage of NAV. But that is only for the portfolio companies funded parts, correct? There is no NAV for the unfunded portion. So how does that piece get expressed in the secondary firm's offer value? You don't, when you buy LP interest, you are taking over this LP existing postition and FUTURE commitment into the fund. Future capital call obviously is 1: With regards the question about risk profiles, the individual company cashflows you aggregate should already reflect their perceived riskiness.

Many secondary models incorporate some level of scenario analysis at the company level; so for a given company there may be multiple short-form LBO models, the output of which may be probability weighted to give a 'most likely' fund level outcome. This approach to analysis mitigates the need to think about different target returns and purchase prices at the company level.

This is the most natural, and easiest way to approach things. If you think a company is way too risky, highly levered with declining margins and overvalued by the GP, then you write it off in your model and assume no distributions from the company.

I would say though that across the full fund its common practice to risk adjust across asset classes; buyout is a 1. If so, what did the case study for a secondaries interview entail?

If so, how was it? Thanks in advance for any info that you can share. Just to add that you should check to see if this secondary fund does any non-traditional deals. So it's not just about buying individual or group LP interests.

In fact, returns are probably higher in the non-traditional deals as these tend to be more complex and more like to be proprietary sourced. In addition to LPs looking to sell their commitments for liquidity reasons, a lot of financial institutions in particular want to offload PE assets for regulatory reasons. Not a bad area to get into I think. Certainly compared to traditional FoF which is in decline. I know that secondaries is about "sales and transfer of an interest in PE fund by an exisiting investor to other investors".

What does it mean in practice? I mean where the money here for PE? For the sake of simplicity, lets assume they had only had one fund e. They sell this fund to another investor for X dollars.

This investor now owns that commitment and is required to meet any additional capital calls, etc. The new investor also gets all the distributions, etc LPs look at this as an opportunity to invest in cherry-picked deals. GPs can use it as a way to raise additional capital for their portfolio companies. These scenarios can get very complex. There are firms that operate FoFs that specialize in buying secondaries some even offer co-investment funds.

Ok, thanks for reply. However I still don't understand what it means that some PE FoF is active in secondary PE market. How does it work? From what I understand now this pension plan can withdraw from the fund and transfer its stake to another investor without really involving the PE fund. I just don't see where the business money is here for PE? Co-investment opportunities can vary, but for the most part LP's won't participate in the management fees, since they are passive, but they would benefit from all returns on their investment.

Co-investment deals are more prevalent and encouraged in countries where foreign takeover rules restrict foreign control..

Secondary Transactions - Demystifying a growing trend (Part I)Some hedgefunds also have dedicated funds that are active in the co-investment and secondary PE market. Say there is PE fund GP and pension fund X LP that committed to the fund and invested following the call.

NYPPEX- Private Equity Secondary Market Liquidity Solutions

So what IaEU tm m trying to understand is why is it beneficial to any PE fund to be active in the secondary market? I assume itaEU tm s beneficial if there is some extra money in it.

If no profit why to complicate your life? From a fee standpoint the GP is no better off because the new LP is basically "substituting" in for the original LP. When a firm claims that it is active in the secondary market, it means that they are operating a fund of fund that is willing purchase commitments when they come up for sale.

The market for secondaries is pretty illiquid, so the buyer may have an opportunity to pick up the commitment at a relatively low price. The new LP sometimes is willing to actually pay more because they believe that the fund is currently in an upward cycle coming out of the J-curve, e. Riemann, PEAnalyst - thanks for replies and links.

It clarifies a lot. Last 2 questions if possible:. In practice, the LP is in it for the "long haul. Vintage is usually determined by the date of the first closing or the date of the first cap call there are some variations here.

It's kinda like a wine a bottle of wine is always vintage regardless of when you purchase it. I would say that the key difference between primary and secondary investments is that the secondary is a more mature vehicle. The fund is likely to have made a series of investments and it may even be out of the investment period.

Could someone shed a little light on hours, comp, and exit opps for secondary private equity? Is it easy to jump to direct PE after experience in secondary? And while we're doling out posting suggestions, I would also suggest you refrain from using ALL CAPS in the subject line. It just comes off as shouting. I am clearly a posting noob. I have an interview next week that I just found out about and would greatly appreciate any wisdom. Secondary PE - What is it like to work in this field?

How does Secondary PE compare to actual PE in terms of nature of the on-the-job analysis, career progression, performance rankings etc? I Have an interview next week at a secondary fund and just want a feeling of how it compares to "vanilla" PE. You know you've been working too hard when you stop dreaming about bottles of champagne and hordes of naked women, and start dreaming about conditional formatting and circular references. Financial Modeling Training Guide to Finance Interviews Banking Resume.

What's so bad about it? I lean towards IBD but I've been try to dip my toes in fund management and it seems like a logical transition. Basically, the secondary PE market refers to transactions done at the LP level.

In essence, the advising firm will be the sell-side advisor to the LP trying to sell thier stake in a GP's fund. What the secondary market does is provide liquidity to the LP's wanting to buy stakes in funds, or exit stakes in funds. The valuation aspect is based on NAV net asset value and buyer's will generally pay a discount to NAV, however if a fund is expected to outperform its current NAV, buyer's will pay a premium.

There is nothing bad about it. I am not sure what a "secondary PE fund" is, however, it is probably a firm that has an advisory side, and an Asset Management side. Regardless, comp is good, and hours a good. A secondary PE fund is the one that buys stakes in funds as described by MoneyKingdom.

In fact it is a Secondary PE Funf of Fund Secondary PE FoF. PE FoFs can do primary investments acting as an LP when a new investment vehicle is created by a PE firm , or secondary investments buying an LP's investment in an existing investment vehicle managed by a PE firm - "Secondaries". PE FoFs that specialise in Secondaries ie. Typically when you acquire an LP's stake in a fund you will value the underlying portfolio companies of the fund.

I've been told that it is quite modelling intensive. You also get to develop a very good understanding of the whole PE world not just the direct-investing-into-companies side. A lot of them actually work with BB Asset Management or other megafunds like BX or The Carlyle Group , buying funds or parts of a fund from them.

What are the mechanics behind valuing a portfolio of LP interests? I would assume you do a DCF of future expected cash flows i. Secondary PE - Minority direct investments Originally Posted: Any views on secondary private equity shops Coller, Lexington, HarbourVest? How is the experience and compensation compared to banking or traditional PE?

Will a junior role associate at a solid place like the abovementioned firms pigeonhole you into secondary PE? To me it seems like some of the bigger funds are doing interesting work and sometimes focus on buying minority direct investments and JV opportunities e.

Sometimes you may do a little direct deal work if the firm does co-invests Some Funds Coller Capital, Saints etc will do a great deal of co-investment and will at times and in the case of Saints will be buying secondary portfolios of assets, rather than LP commitments and therefore there will be extensive valuations, modelling etc. I got a friend who has an interview at a PE fund that operates in the 'buyout secondary market' as their website states. Quick question; what the hell does that mean?

I've lost all my money, but the wife is still here.

Private equity secondary market, valuation analysis | AltAssets Private Equity News

Secondary funds buy LP commitments in the secondary market. For example, if a LP in a PE fund wants to get out of the fund usually for liquidty reasons , that LP commitment will be sold on the secondary market, often for a pretty deep discount, to another buyer in this case, the secondary PE fund. Do these funds I know there are different strategies scoure the market for distressed LP and take advantage of the deep discount, thus reducing the initial cost of investing in that fund?

Not entirely sure how the sourcing process works, but usually secondary buyers are insanely profitable for one main reason, which is the lack of the J-curve.

When a LP wants to sell its commitment due to whatever reason, chances are its investment has already hit the bottom of the J-curve.

The secondary buyer will then pick up the commitment at a discount in addition to the discount the NAV is already priced at due to J-curve effects. When the underlying investments start maturing, the value of the commitment could rise tremendously. As a multiple of cost, if you buy an investment at a lower cost base instead of the original cost and it returns X amount, you make much more than if you were the investor who invested at cost. The PE secondary market is relatively young, but is starting to fill up with more competitors who are actively looking for investments since they can be really profitable.

Agree with tan, usually for a discount but keep in mind, it is a discount to the net asset value, not the buy-in. I would think working at a secondaries FoF has more analytical work to it vs. Keep in mind there is a difference between secondary purchasing LP interests and direct secondary investments, where the firm will purchase portfolio companie s from the fund. PEguy, thanks for clearing that up for me. I feel like Alice after she fell down the rabbit hole, a whole new world.

This seems like real spreadsheet monkey work. Doing your own valuation of companies, in for example BX 's fund portfolio. Coming up with your own estimate of a reasonable price of the LPs commitments. Last follow-up for now: What is the benefit of investing in a PE fund that operates in the secondary market vs primary market?

I assume the primary market fund has the biggest staff of number crunchers, thus taking longer time to analyse and investing the raised capital. I'd say the main benefits are diversification and returns. PE itself is not as correlated to the market, secondaries even less so. In the secondary market, you can make money even from the poorest performing fund, so the returns can be great.

Imagine buying an LP's commitment at 0. That's a home run Even if the PE fund fucked up, the secondary investor won big. BSTN05; would you care to elaborate? Wouldn't direct secondary investments act as another PE fund in the primary market, making the fund management elligble to positions on the board? I would just clarify some of the comments about Secondaries generating great multiple returns.

Secondary investors and their LPs , are looking for shorter duration vs. Think of Secondaries as a lower-risk investment, they rarely lose money and return capital quicker than a typical PE investment. Think of it this way, if you're investing in a portfolio of companies that should be years from exit, you probably have a good idea of the exit value. But your capital gets returned quicker, so your compensated with IRR. There are a lot of Secondary firms today willing to take a sub 1. That's pretty good if you ask me.

In terms of dealflow, there are plenty of intermediaries who are paid by the people selling their stake to find buyers. Secondary PE - Differences between conventional secondary investing and secondary directs Originally Posted: Can someone please explain the differences between conventional secondary investing and secondary directs?

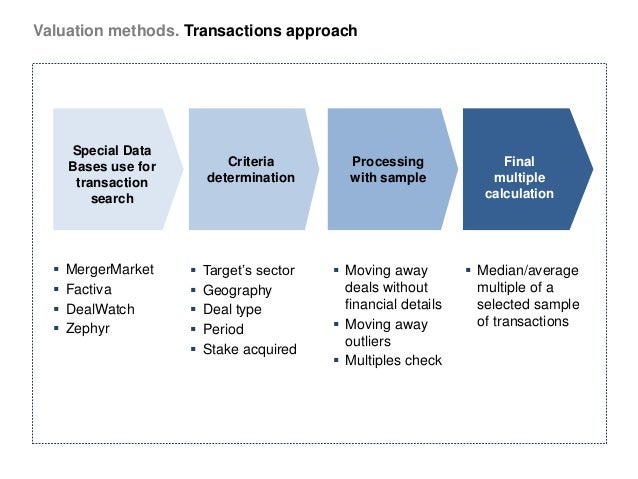

Is the former related to buying an LP's stake in a PE fund? How is secondary direct investing different? Also, can someone shed some light on valuation techniques used by conventional secondary and secondary direct investment firms? Is the primary valuation technique a "sum of parts"? How about other techniques transaction comps , DCF of portfolio companies, etc. See my WSO Blog. Secondary PE - FOF Originally Posted: First I've heard of such a thing.

Global Healthcare Private Equity and Corporate M&A Report - Bain & Company

Recruiter recently pitched me a role at a FOF shop. I'm on the pursuit of happiness and I know everything that shine ain't always gonna be gold. I'll be fine once I get it. I think it's more interesting than regular fund investing but it's still FoF - you're evaluating an existing portfolio of investments and deciding what discount or premium for the best funds to NAV that you're willing to bid. I have not seen anybody move from secondaries to the direct side.

No problem - let me know if you have any other questions or decide to interview for the role. I have some friends in secondaries and know a bit about the strategy.

I will add that with the increasing maturation of the asset class, the secondaries market is expected to grow quite a bit in the coming years. IB PE HF RE CO TR AM ER CF ALL JOB BSCH OFF FASH TREND BEST.

Home Forums Private Equity Forum Secondary PE Modeling.

Log in or register to post comments. Sorry, you need to login or sign up using one of the blue buttons below in order to vote. As a new user, you get 3 WSO Credits free, so you can reward or punish any content you deem worthy right away.

See you on the other side! Hedge Fund Pitch Template. Best Modeling Courses - Finance Training. Excel Model Templates and Training. Financial Modeling Training Self Study Courses. Private Equity LBO Modeling Tests. Investment Banking Interview Case Samples. Apollo VI - 1. Modeling Training - Special for WSO Members.

Thanks m8 - very useful. Can you clarify a few things: Private Equity Case Interview Samples. Investment Banking Interview Brainteasers. What did you mean by: Wall Street Prep Discount - Financial Modeling Courses.

Investment Banking Interview Questions. Hedge Fund Interview Sample Pitches - Long and Short. LBO Modeling Tests for PE Interviews.

Hedge Fund Interview Questions. Awesome - thanks so much - very helpful. Toughest PE Interview Questions. Hedge Fund Pitch for Interviews. Investment Banking Interview Questions and Answers. Here are some simple scenarios: Same when it comes to co-investments. Great for LP, but where is the deal for GP? Thanks in advance for explanations! Ok, IaEU tm m getting there The point I donaEU tm t get: Here are some links: Last 2 questions if possible: Thanks Guys for explanations!

Private Equity Interview Questions. What is a reasonable target return for a PE secondary fund? SECONDARY PRIVATE EQUITY Originally Posted: Never ever ever triple post. You have turned this entire forum against you. Contrary to what you may believe, caps lock is not cruise control for cool.

Wow you REALLY want to have this question answered don't you!? Pity I know nothing about this subject P I second VCmonkey's comment, triple posting is sacreligious p. I know what Secondary PE is. I want to know what it's like to work in Secondary PE. Don't work in secondaries. My old roomate used to in 'secondary PE' Basically, the secondary PE market refers to transactions done at the LP level.

There is a lot more to this, but i'll expand if there is any questions. Some very good secondary firms out there doing interesting work; Coller Capital for instance. Any tinsight would be much appreciated. Investment Bank Interview - Toughest Questions. CNBC sucks "This financial crisis is worse than a divorce.

If I knew how to award SBs, you would get one. Once again, if I knew how to give you a SB you'd get one. What an ironic username. Sb'ed, appreciate the insight. Must Reads on Wall Street Oasis. How to Make VP in Private Equity. Secondary Associate roles- Modeling exams and Case Studies? Secondary Private Equity Funds Compensation Where to move? Please tell us a little bit more about yourself to send you the most relevant notifications Closest City - Please select a City - New York Boston Chicago Hong Kong Houston Los Angeles London Philadelphia Toronto San Francisco Singapore Washington DC Atlanta Austin Bangalore Berkeley Buenos Aires Beijing Calgary Charlotte Dallas Denver Frankfurt Madrid Miami Melbourne Montreal Moscow Mumbai New Delhi Paris Rio de Janeiro Salt Lake City San Diego Sao Paulo Seattle Shanghai Sydney Vancouver Other.

Popular Content Week Month All Time Comments Investment Banks as the Houses of Westeros In honor of GoT S7 premiering next month, I'd like to pose a simple question to the WSO community. If the investment banks were the Houses of Westeros, which would they be? An Introduction to Suits - Welcoming the Analyst Class As we welcome the Analyst Class, I have some knowledge sharing for the incoming monkeys.

Suits come in three different constructions: Canvassed suits Canvassed suits have a free-hanging I love you guys. I just realized nobody on this forum ever takes a second to appreciate all the hard work we put in and all the great knowledge we share with each other. A year ago I graduated from HS and entered my local CC because I had no clue what was really for me. I was a Computer Science major at the A little about me: I don't come from typical financial services major nor have I ever wanted to be an IP myself.

All the same, I love my job and don't wouldn't trade it or my firm for the world. Saving Time Bitches That's right. Although doing deals and pounding out diligence is sweet, the Hamptons are sweeter. How can we save time to get out of the office faster? The market is turning rapidly In the last 60 days I've seen so many deals fall out. Not just mine but other brokers across several asset classes. Buyers are hyper critical of everything.

Sellers still want crazy money Apartment investors selling at 4 caps and trying to buy retail at a 6. They see the end in Finally cut it Guys, So I finally cut it 3 years after graduating from undergrad, and I would like to share my story to you guys as this forum has been staying with me along the way and indeed the break-in cases here keep on pumping gas into me whenever I got rejected. A bit about my background: Amazon Buys Whole Foods Amazon.

Amazon is buying Whole Foods WFM Career Resources Investment Banking Interview Questions Private Equity Interview Questions Hedge Fund Interview Questions Consulting Case Interview Questions Financial Modeling Training Resume Reviews by Professionals Mock Interviews with Pros Company Specific Research. Forum Topics New Popular Comments. Are West Coast hours really that much better? I am on the West Coast and work hour weeks in PMG. I eventually want to move back to the East Coast but are the hours really that much more brutal?

What's the cause of the difference? Summer Internship in China I am currently a rising junior at a semi-target school preparing for recruitment, which is happening very soon. I will be spending the entire summer interning in China, and have just started the job WSO Series 7 Exam Prep Launched Fellow WSO Members, I'm happy to announce that we have launched a new Series 7 training course today! Take a look here and let me know what you think please: Over 20k small businesses have Looking towards next summer, I would like to get some startup experience on my resume.

Has anyone interned at a startup? What is the recruitment process like?

And how valuable would this experience Any value to a summer internship before starting a PhD program? As the title says, I'm heading to a microbiology PhD program fall got accepted and then deferred one year , and I'm currently talking with several life science consulting boutiques about the Recently had an interesting discussion with two friends about wearing pocket squares. I personally love them--one of the first things I notice. What do you all think of wearing them?

Potential Market Facing Opportunities Out of a Financial Analyst Internship at a top Asset Managing Firm? I'm heading into my senior year at a mid-level school with some pretty heavy corporate finance experience on my resume.

I'm looking to make the switch to something more market facing, as being a How many cold emails is to many for BB? Quick question about how many cold-emails to send analysts at BB firms. Today I sent about 15 emails and am trying to get a better understanding of how many I should send per day.

I know at boutique Preparation for Interviews When preparing for an internship interview, how in depth do I need to go into understanding DCF, LBO, and the 3 financial statements? I've researched and found out that the technicals are important, Do full time analysts who fail training open up new spots in the class?

Hey all, Quick question: If a handful or even a select few people from a full time IB analyst class fail out of training somehow or don't pass tests, would it then open up that number of spots for Hi, At first about a public company: What makes for a good Associate? Incoming post-MBA associate at a top tier NY BB. Answer however you wish, but interested in: Hedge funds with big PM AUM like Viking? Jun 22 All day to Jun 23 All day.

Jun 22 - 8: WSO Happy Hour - Paris: Fri, 23 June, 8: Jun 23 - 8: Operational and Technical Challenges for PRIIPs. Jun 26 All day to Jun 27 All day. Jun 29 All day to Jun 30 All day. Recent Jobs Senior Associate Managing Partner - Venture Capital Private Equity Analyst Product Development Lead - Investment Banking Technology Start-up. See you on the inside! Join us and get the 6 free lessons with 1 click below! Sign up today and Get 6 FREE Financial Modeling Lessons Sign Up. Join the WSO Monkey Troop!

FAQ Finance Dictionary Advertise About.