Nifty options writing strategy

Earlier, only monthly options contract were available for trading for all instruments including stocks and index whereas now you can trade in Bank Nifty Weekly Options contract where the expiry day for these weekly contract is Thursday of every week.

Options give an edge to you as a trader to make money even when the markets are not trending and stuck in consolidation band. It seems to a good place to start and feels to be a magical wand which will lead them to new heights by simply buying the cheap OTM options and make big lofty profits. All the craziness went into a drain for most of the new comers when majority of their trading ideas of buying cheap options…… went into become nothing but Worthless and all becomes an Apocalypse.

This happens because of the fact that the trader need not to be right only with the direction of the price movement but also has to be right with the timing. If we are wrong about any of the above, then it will result in the loss of the premium paid. Ask yourself what you choose to trade when you entered the trading market for the very first time — Buying Options as the risk is limited or Selling Options which has more risk involved?

Do you know that the biggest mistake that most traders commit is that they think they should trade everyday. They think that trading is all about being in front of your trading desk every single day, and buying and selling left and right. And, they fall under the trap. If you really want to avoid big trading losses, you need to have some facts and reasons to trade.

And believe me you will need to learn a lot of patience to understand the market, framing up and following your trading rules. And, how professionals trade the markets to avoid committing the same mistakes again and again.. You might have read and heard million number of times that the risk with buying options is limited to the price of the premium paid.

But Do You Know that we can even get trapped and lose more than the value of the premium even when you are buying options and what if I tell you that you can incur loss even after having a profitable trade.

Lets come back to options…. By this we do not mean that buyers of the options do not make money or we should not buy the options anyhow? So whenever you are buy options, specially the ones which attracts a lot of interest from the new comers i.

When you know that the market will rise or fall because of some pattern completion on charts or some other reasons, then it make sense to buy options and achieve some pretty good results. Similarly, there are ways when we can buy call option with a close stop loss for intraday when we are expecting bank nifty to complete a pattern and getting ready to rally and make decent money on our trade.

But this requires you to be very right with your analysis specially with the direction of the market. We here would like to make it clear that it is not that we do not buy options.. But that strategy has different pre-requisites and should be implemented when we are expecting a clear directional move in bank nifty after clear bullish or bearish patterns.

Buying will be profitable only when we can analyse and predict the direction and a big price momentum in the underlying while selling can be profitable when you are right with the general thought that market may consolidate or not go above or below some major psychological marks. Therefore, newcomers should not fall under the trap of trading options by buying the cheap calls or puts just because they are trading at low prices.

Just as like …. So, it is not the price at which the option is trading rather it is more about evaluating the probability that we are expecting for the success of the trade. The big consideration here is to first know and understand the opportunity and probability of the success of the trade specially when trading options rather than the cost of buying it.

As just because Bank Nifty Weekly Call Option is trading at a cheap price of Rs. There is a reason why it is trading at Rs. So, it would be better to rather write the call option to receive the small premium value as there are higher probability that market may not reach that mark till the expiry.

So, whether the profits are small or large it should be sure which will help a trader to take big positions and make big sure profits.

To make a success in options trading, restrict yourself with first researching the price movement of the underlying BankNifty to predict where it will head towards within your stipulated time then go on find and enter the right option contract with justified reason of why you are buying or selling it.

Also, when you are trading Weekly bank nifty options, then the time value will evaporate very fast after the close of Tuesday. So when buying options, you need to be quick, sharp and right with your analysis about the price movement you are expecting and knowing in what time frame…. This we have discussed at the end of the post outlining the benefits of writing an option than buying options.

Save your time and frustration. How to Make Money from Trading in Indian Stock Market? Part VII — Getting Started With Trading — How to Trade Options? Then you need to read this. Part I — Getting Started With Trading Options — How does an Options Trade Work? As a new trader, it is important to make your trading task more simple. Get deep into understanding how the options trade work in real market. It has something to deal with the risk of the trade.

How to Trade Bank Nifty Futures? These elements will help transform you from a Aspiring Trader into a Legendary Trader. Bank Nifty Options Strike Price has a gap of points within each contract. At present the Bank Nifty Index is , so calls and puts of strike price for the weekly contracts from to are available for trading with successive contracts of , , and so on. Table 2 — Bank Nifty Weekly Options Chain. Check out the real time prices of the all the contracts available for trading BankNifty Options NseIndia.

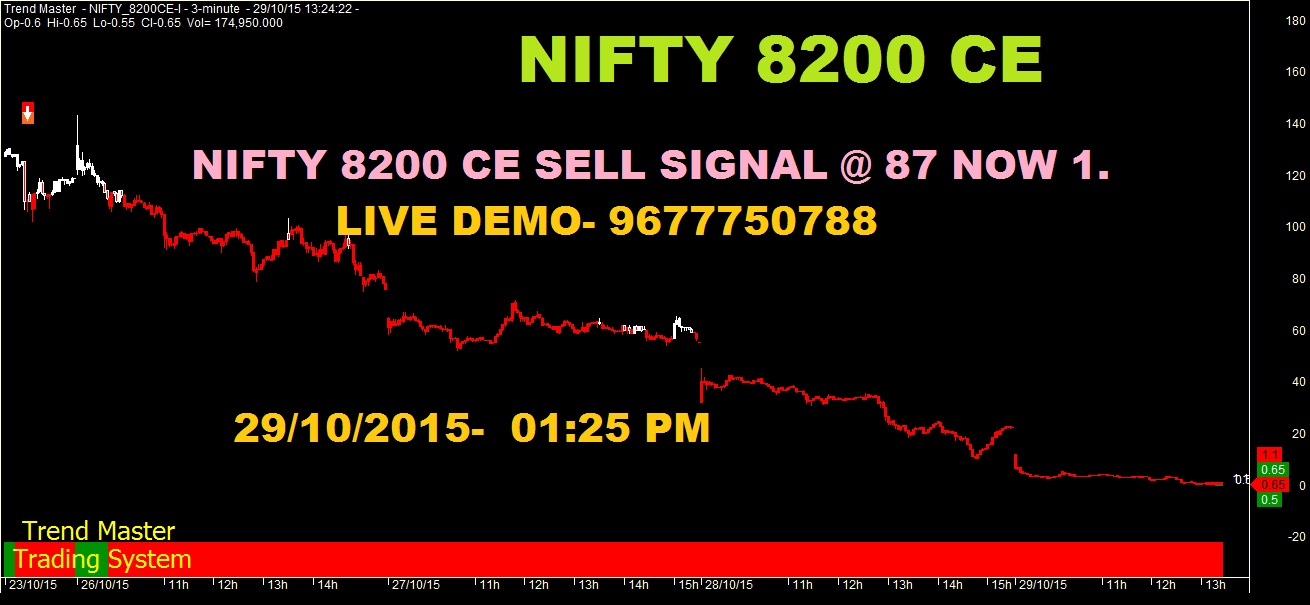

If you check the chart I, then we can outline that the call which are above the current market price i. Why would the call or put option which does not have any intrinsic value rather all the price of the premium is the time value are actively traded? This is because a lot of writing is happening for the call option and put option i.

To check the most active bank nifty options. This will help you to know the most important levels as support or resistance the market is betting on.

Weekly options has surely widened the scope of trading opportunities available for a Bank Nifty trader. As now the trader can take positions in weekly option contract by paying less premium than he had to pay when entering the monthly contracts. Earlier the writer or buyer of the options faces a lot of trouble and need to keep in aligning their trading positions as there was big time gap between the expiry of the contracts.

Similarly the seller of the options will have to predict the market for few days to take the benefit of the opportunity by writing the bank nifty weekly options. There are generally two strategies that a trader can choose from: Buying option could involve buying calls when expecting an upside in Bank Nifty Index or buying puts when expecting a fall in Bank Nifty Index.

While on the other hand, Selling options involve selling calls or put options of the Bank Nifty Contract. It is very important to understand what constitutes within the premium price of the options contract. Intrinsic value is what the options real or self worth is. In other words, what will be the value of the option if the contract is to be expired just right now.

Say, BankNifty is at and call is trading at Rs. So the time value will become Zero. Pricing of options are done on the factors like Value of underlying, time to expiry, etc. For Example, when BankNifty Index is trading at the weekly call option of strike price is trading a premium price of Rs.

The call option has no intrinsic value while you are paying Rs. Therefore you are expecting bank nifty to stay above i. So, even after the bank nifty index has risen from to but you did not made any profit because you paid the extra value of Rs.

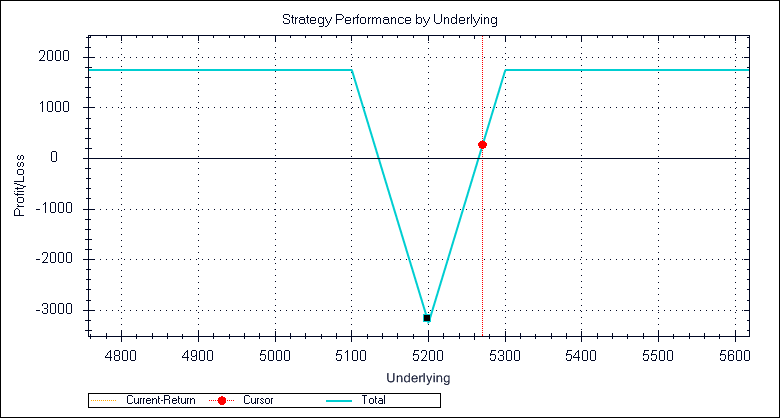

While when you are selling an option you will be receiving the premium price for giving the buyer the right to buy the option which includes the time value which usually works in the favor of the sellers of the option contract. So, sellers expect the market will not go up above the strike price of the call option he has sold and not go below the strike price of the put option he has sold. Generally seller of the option contract enters the market during the third or last week of the monthly expiry but now its just the matter of the five trading sessions and higher probability trades can be entered by writing the options during the last days of the contract as most of the time value evaporates fast during that period only.

So, even after the bank nifty index has risen from to the seller is in the profit.

So, options trading involves not only predicting the expected price move of the underlying but also to access the time frame within which that price movement will happen as you will be paying the time value when buying a options contract. There are various benefits for this: Now traders who would like to take positions in Bank Nifty can do so by buying calls or puts at a price lower than what was available with monthly options.

Better Control on Trades. As with monthly options, a lot of aligning of positions were required to be done within the month. So, these weeklies will help them to have a better control on their trades as now they have to foresee the market for 5 trading days and not more than what will happen in the next 20 days.

Opportunity to Trade as per market moves 4 times a month. Now time decay opportunities will be available 4 times in a month as compared to once every month. Traders get active during the last few days of the expiry to write OTM call and put options. So, now they can do so by trading every Week. Trade Major Events with Less Risk. Weeklies will help traders to take positions for big events like RBI policy, Brexit, Election Results and that too with very less risk.

Bank Nifty crashed from to and returned back to follow its current up trend. So, portfolio hedging can be done by buying weekly puts at low cost. Now it is much easier and cheaper to deal with hedging for event risk using weekly options. Opportunity for Small Traders. Weekly option puts are excellent and cheap hedges to cover other positions long term holdings while far weekly call options are great tool to work as Covered Call to write high probability bets.

This will help increase participation from all variety traders so there will be less gap between bid and ask prices. So a quick entry or exit can be done without worrying. And yes, lastly increased participation will leads to more income to exchanges and brokers.

Keep in Sync with developed Markets. In other developed nations, weekly options are available for trading on index as well as stocks to help traders hedge and take short positions on according to market conditions.

Also, apart from weeklies, there are long term options on index and stocks are also available for trading to take big time positions by paying loss cost. A Win-Win Situation for Every One. Hopefully, we are going to see more weeklies on Stocks and other Indexes. Get get on with our shoes and get ready to design ideas, strategies to make money from these weeklies. Pricing of the options are majorly driven by the price movement of the underlying which in this case is Bank Nifty Index.

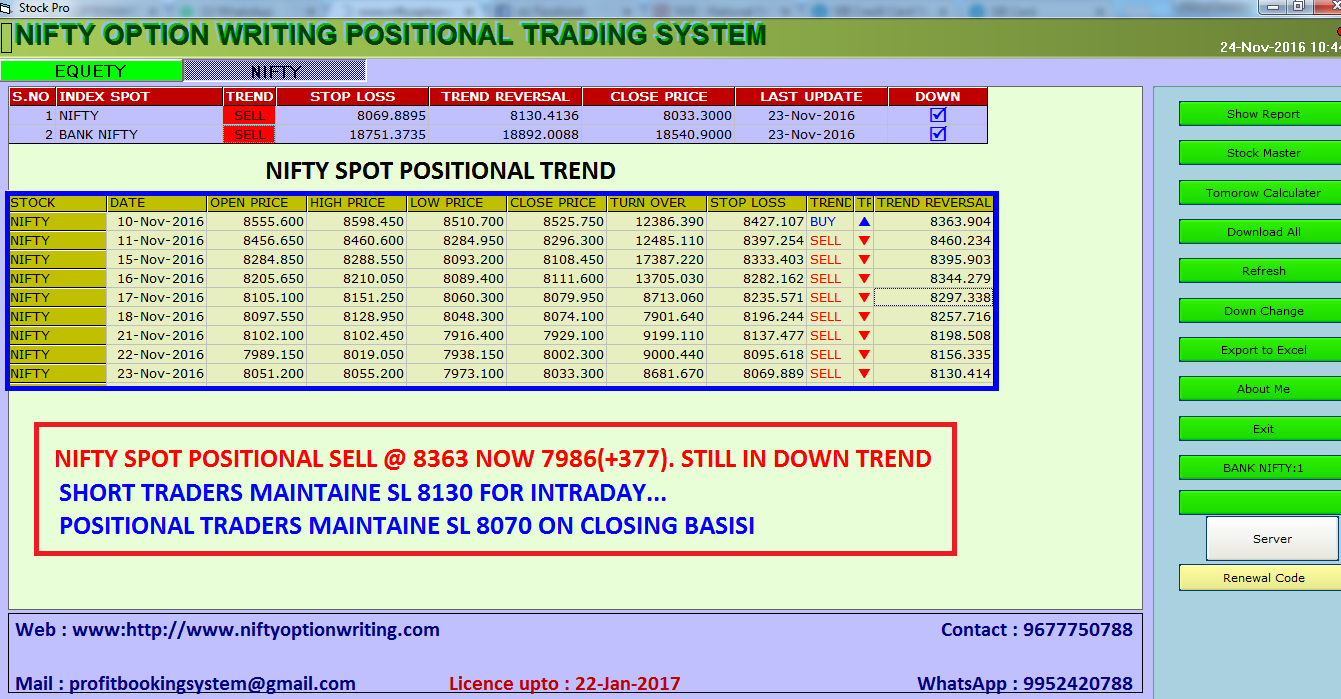

So, to judge out where the options will head towards it is important to give due consideration to where the Bank Nifty Index will move. There is another way of seeing this — Expecting What the Bank Nifty Index will not do in the next few days?

Many traders do not feel confident in trading bank nifty futures even after they do a great work on research but they are good at evaluating after certain price action of the market what levels markets are not expecting to move above or below. If you are writing bank nifty weekly options right before the expiry day you need to judge out what the market is expected to do within the next day, which levels are important as support and resistance which market may not break even in case there is any high momentum price movement.

This may not require much to predict the quantum and time of the move rather estimating what market may not do till Thursday. As we outlined, the option premium has the intrinsic and time value at all the time. A chartist has an advantage to get the benefit of this underlying opportunity. Say if a trader can understand the position of the market and conclude that the market has rallied big and now sitting at a major resistance of which requires consolidation to happen in a big band to decide whether to go further up or starts correcting then they can sell the call option of strike price above mark as they will expire worthless if the market may not go above it.

This illustration seems to be so easy to trade. But many of you might be abusing that who the hell will tell us that the market will face the resistance ? So, it totally depends on what you are good at calling the market?

Can you make it up that the markets are going to spend time before going up or down or the markets are going to be blasting up or staging lower? Each type of concluding evidence will help you decide what strategy to choose to take the utmost benefit. So, who the hell is making money if we are buying options all the time to take less risk and ends up with worthless options? Writing an option puts you at a great advantage as the decay of time value works in your favor.

Writing options requires full margin to trade as in the case of the futures trading. Chart readers are always at advantage as they can see other important aspects that is not considered while evaluating the pricing of the premium. As the time value evaporates very fast in the last two days for the weekly contract so a big line of trading positions are initiated in the weekly options market late Tuesday or during the trading hours on Wednesday with an expectations of where the market can most rise or fall till the expiry day i.

So, our task starts by analyzing the big picture and price performance of Bank Nifty Index till Tuesday to predict what can happen on Wednesday and Thursday the expiry day.

If we can make up that market will not rise or fall below some major levels then we can start writing the options to take the benefit of the time value decay. Chart 1 — Bank Nifty Weekly Expiry Chart 5 Minutes. For example, the very last blue line represents the weekly expiry of June 16th, while the pink line before it represents the closing position of the market on Tuesday i. Choosing a right option contract is very important specially when writing the options. Always go with the charts and try to write the call or put option which is far away from the current market price but has strike price close to some important top or bottom.

Zero Loss Option Selling Writing Strategy no loss only profit sure profit options trading strategy.

This will generate a very small profit but will put the probability of working right in your favor. So, the task here is to analyse the big picture of the market till Tuesday or early Wednesday to forecast where the market can go maximum up or down till it expires on Thursday.

Therefore, we need to anchor the major support and resistance levels of the bank nifty index which will serve as an anchor for us to trade in the coming two days till expiry. Say on 14th June, Wednesday we can see that the market has a strong resistance at or above which again serve as a sellers place. This requires us to trade with conservative thought and will give us another anchor point to consider as support which now is Now, we can analyse the market position early on the day of the expiry to conclude maximum it can move up and down with in the day.

As on day of expiry, the market had a big fall within the first few hours of the trading day.

But as we analysed that the market was coming to a major support level of where it had a big consolidation and went up earlier. But we cannot write the call options after this crash.

So we have to wait for the market to rise up so that we can start writing the call options of or and digests in all the premiums with the time decay. If market did not reached the levels till the closing time then these call options will expire worthless or in other words will become Zero. If you see the chart 2, the market started to consolidate in a band after the rise which benefits the option writer.

To check this further in another situation, Lets take the market position as on 29th June, i. Wednesday as now only one day is left for the expiry of the June Contract. Chart 3 — Bank Nifty Weekly Chart June 15 Minutes. There is no clear pattern forming up to conclude which levels can be act as anchored place to take stop losses as market in current phase is in strong intermediate up trend with no corrections.

At mark, market has formed a double top which may again create a lot of problem for the market. Also, there is a major gap down from that level so even if market will reach that level it will just close the gap.

This becomes our anchored top to write the call option of mark tomorrow i. Table 3 — Bank Nifty Weekly June Contract Options Chain. From the table above, the call option is trading at Rs. Also, if you see it is the only call option which has the highest positive change of open interest of 1,20, contracts which signifies that this is the option which has most of the interest of the market participant today and surely they are not buying it rather writing off to make Small But Higher Probability Profit.

But as the markets current trend is up and momentum and volatility is huge so we may skip writing the call this expiry as the market can still continue the up trend and even opens gap up tomorrow.

As the volatility is huge so writing of options or carry any over night position specially when writing options in not suggestive as market map open with gaps the following days.

So, under such cases, always wait till the day of expiry and trade as per the market move which happens in the early hours. Also, the open interest is increasing in , put options by 1,54, and 1,26, contracts with highest open interest of more than 5. So, writing of calls seems a bit less attractive where if we go with the current trend of the market and high increasing open interest in puts of and , the writing of puts or buying call seems to be a better choice on the expiry day tomorrow.

The Idea Here Is…….. Whenever markets are not forming any clear bullish or bearish pattern and we are unable to find places to enter the market and place our stop losses so cannot buy options, then writing of options of strike price above or below the major anchored top or bottom is the only way for the trader to take the benefit of time decay on or before every weekly expiry.

Wait for the market move till Tuesday Close. Analyse how far the market may go in any direction today even when there is high price momentum. If volatility is high and a trend is underway, wait to see the market movement in early hours on the day of expiry to take any positions.

Check which options has higher open interest and changes in the open interest to understand which market is seeing as major support or resistance near your anchored top or bottom.

If even after reaching resistance market starts to show increase in open interest in puts expect market to keep going with current up trend. So skipping writing calls is what makes sense with buying calls or writing puts will put us under great chances of success. Write the option above or below the major levels as and when market moves towards it but when it is still far off from major levels.

As options pricing do not consider these technical aspects of markets, so the right analysis becomes a sword for the trader to make great trades with higher chances of success. The major drawback of this strategy is that it did not give us place to put up stop losses as even after shorting the option, the premium can rise with the movement against but still not move above or below the strike price and later become Zero.

Thatswhy it makes sense to trade near the expiry days i. Trading Bank Nifty Weekly Options in the Last Hours on the Expiry Day. There are another set of traders who just get active on the last 2 hours of the expiry day. Seeing the trading for the complete day they come to conclusion for the new levels which market will now anchor as resistances or supports.

So during the last minutes, levels which are points away from the current market needs to be anchored on. So, the idea again is here to conclude What the Bank Nifty Index will not do in the next minutes? Also, some times during the expiry day which will happen once or twice every month, market will be near the major resistance or support levels.

Traders have a tendency to book the profits during the last hours of the trading day when the market has moved in one direction during the day. So, those levels becomes our anchor levels to write the call or put options above or below it to take the benefit of time decay. The premiums must be trading at very low levels of Rs. Wait for the market movement till PM on the expiry day i. Also, check if the market is near some major resistance top or support bottom.

Market may not go above or below it just because traders are reluctant to enter new buy or sell positions at the end of the day to avoid carrying any overnight positions whenever the markets are near these major levels which may give surprises by tomorrow morning gap up or gap down.

Also, if the market has been swiftly moving in a single direction though out the day and reaching the major sellers or buyers area then traders who bought during the day starts to book profits before the close. So, this may push the market lower or higher and not breaking these major resistance or supports. Again, as options pricing do not consider these technical aspects of markets, so the right analysis becomes a sword for the trader to make great trades with higher chances of success.

An important point to remember here is that the options will expire as per the settlement price of the underlying which in our case is Bank Nifty Spot Index. Settlement price is calculated as the weighted average of the last 30 minutes i. Do not confuse it with the last traded price. So if on any day the bank nifty index rises in the last half hour then surely settlement price will comes out somewhere in between the last half hour range.

The objective to detail out about options and writing strategy is to show you how big traders create a lot of positions by writing options according to the market conditions. This can also be justified with increasing open interest in calls and puts which shows big writing off these options. This is not the only way to trade options but there are other strategies that we may follow which with time will keep on sharing.

But Remember, Whenever markets are trending strong in one direction and volatility is there then you should surely avoid writing the options as this may increase the risk and go all against you..

Whenever the volatility is huge it is always better to buy options Calls or Puts then writing or selling options first. So, be sure of why you are buying or writing the options.

Because if the trend is strong and markets are drifting in one direction from last few days and you still follows the similar strategy of writing options to get few profit points you might get into trouble. You should know that the when the markets are not trending, stuck in band during the expiry days and no trending pattern is getting completed to let the market run in fast momentum in very short time frame then you can make out the important support or resistance levels which market may not break with higher probability and write options.

But when the trend is strong or patterns for bullish or bearish moves are there then writing will surely not be fruitful or sometimes may out the trader into trouble when the market reverses and corrects fast. Therefore, always first analyse and give complete importance to the understanding the what the bank nifty is expected to do in the next few hours to day to decide what is best strategy to adopt to trade bank nifty weekly otpions on or near expiry.

Just like buying options is always not the right strategy similarly writing options is always not the right strategy too. But only when you trade right.. Ask yourself why some has so much of interest in these far away option which has high open interest? Are they really buying it all because they are trading at cheap price? To make money it is not always important to know what the markets will do.

These are not the only way to trade it…. There are many many other ways to trade in the market.. Do find one which is within your comfortable zone and keep stretching…. Make big profits and achieve Sensational RESULTS. And more consistent when trading bank nifty weekly options. But Responsibility to use it wisely is what makes the miracle to continue. Leave your answer in the comments, share this with others. Please note that all the information shared is solely for the general information purpose only.

No information, views, opinions or examples constitute a solicitation or offer by JustTrading. Happy to hear that… Thanks for taking time to share your words. Heartful thanks to you for sharing such words. Its really motivating for us to keep up the pace for sharing more great content. This really gives us a feeling of satisfaction for our effortful work.

Thanks a lot and we are delighted that you liked our work. I like what you write. Really good to hear that you like our post. There are a lot of content available online but unsure of any crisp and clear on chart reading.

As most of the content talk only about candlesticks and technical indicators. We are working on writing content on chart reading and how traders can use chart reading to refine their trading further and get an edge just like professional traders. Once we are done, we will send you an update on your email or whats-app. Till then you can read a short one on Charting.

Getting Started with Technical Trading — What is a Chart? Also, refer to the Recommended Trading Books that helped us in our trading.

That is the reason why markets reverses very fast after big up or down moves… Any mis-pricing generates trading opportunities for arbitrage or less risk trades.. The one we shared in this same article is the one we generally use to trade during or near the expiry. There are some option software vendors in the market but we have not reviewed them till yet.

Let me try contracting some and find which are worth buying. Once we do it we will review it here on the website.. You can also share the ones here, if u find some good one. Sir, please excuse me. I have a request. Above post has very confusing language. Some sentences are absolutely beyond comprehension.

I do not wish to criticize. But simple, short, precise structure will help novices like me to appreciate your work.

In many places above you have covered call and put actions together. In some places you have talked about call, put, buying and writing in a single breath. Even an experienced option trader cannot make a head or tail out of it. I have tried keeping things in great details as possible.. To help all get the core of the thought.. Actually, we have shared all the links in between to other article which relates to basics of options, bank nifty futures, etc to help new comers to get the grip on options and bank nifty..

But yes, I understand you concern and whatever questions, or confusion you have related to this article you can post it here.. Any number of queries. Feel free to share… Will be more than happy to discuss and learn new things from traders like you.. And that what we believe in — An open environment where our readers can ask us anything they wish to. Waiting for your all questions… Even our other readers will be happy to know new sides and problems they can face while trading bank nifty weekly options..

Thanks a lot for explaining options in an easily comprehensible manner. I am amazed reading your thoughts.. Thanks a lot Karthikeyan for such inspiring words.. Your comment has also triggered my passion to right more great stuff.

Sir, Great series of articles. Specially this one Turn bank nifty …. Do you have a write up on entry price? As an example at one place I decide that call should be shorted 14 Rs.

I would decide this on Tuesday evening. But when I fire my order on Wed, the volatility brings price down to 4 Rs within first 20 minutes of trading and then not sure if there is any juice left in it. As traders we never launch market orders. How to deal with this situation? I am really glad that you like the work.

In your example, yes the prices generally fall much faster within the last days of the expiry due to time value decay but such fall from 14 to 4 might be of the case that the market has opened way lower than Tuesday close. Always it better to place in limit orders when trading the options for such small price gap as many of them have big bid and ask price between them.

The only way to deal is by either enter on Tuesday evening or trade on Wednesday the option which is more close to the index value by evaluating well what the market is going to do till the expiry… What levels it will not break.. What tops or bottoms are important… and what the market is due for.. Margin for shorting options is more or less similar to what is required to trade in bank nifty futures.

At present it is approximately Rs. Dear Sir, I want to know about options selling. Here i am putting some question so plz help me by solving these questions. Suppose i short sell Bank Nifty call at 20 and that time spot price is If expiry day spot price is and premium is 0.

So i am in loss or profit? Suppose i short sell call and i am in loss and i want to hold my position till the expiry. So is it possible and if yes so how? I short sell Bank Nifty call at 30 spot — and the expiry day Bank nifty close at and premium became So am i in loss? Good to see you are finding answers to your queries. I have tried to share my thoughts on the questions in detail.. Hope it helps answer your queries rightly.

When you have shorted Bank Nifty call that means you are expecting market to expire below to pocket in the full premium amount of Rs. And, the bank nifty index expired so the call will become worthless i. So, as you have shorted it at Rs. Even if you forget to buy back the shorted call option — You will still pocket in the full value of premium i.

If you have sold short call and you wish to carry the option then you need to take care of M to M loss everyday as future and options are settled everyday.

Suppose, you shorted call option at premium of rs. Also, if next day the premium went down and close to Rs. Also, you will have to maintain the total margin requirement which these days will be approx.

If you have shorted the bank nifty call at Rs. So, you will have to bear a total loss of Rs.

Basics on Options Shorting/Writing « Z-Connect by Zerodha

I hope the answers have solved your queries. Thanks Rajat For your kind words…. We started this with the same thought of helping new traders to not commit mistakes that we even fall into during our early days. Hope to continue the same in the future.

Its very great explanation on Bank Nifty Writing strategies , which i ever found in WWW. I have small query on margin required for writing options. There is a slight margin difference between the different strike prices where the 60K might become 65K or 70K. So, atleast you will require these days to carry overnight position in options selling. But if you are trading for intraday say writting on the day of the expiry, then you might be able to do one lot of short selling at 20k by getting intraday MIS exposure.

If you have any other query, do post it here. I will be more than happy to help. About Privacy Policy Disclaimer. Just Trading ALL MEN ARE CREATED EQUAL, THEN SOME BECOME TRADERS! Menu Home About Start Here Products Resources Get Inspired Contact.

How to Turn Bank Nifty Weekly Options into a Regular Income-Driving Machine? Why New Traders Feel that Options Trading is Like Gambling?

Wowww… It seems to a good place to start and feels to be a magical wand which will lead them to new heights by simply buying the cheap OTM options and make big lofty profits. What happens then, All the craziness went into a drain for most of the new comers when majority of their trading ideas of buying cheap options…… went into become nothing but Worthless and all becomes an Apocalypse. Turn Bank Nifty Weekly Options into a Regular Income-Driving Machine.

Signup now and you will get once-a-week update when we do awesome things around here! Related Posts Make Money from Trading in Indian Stock Market: Latest posts by Just Trading see all Day Trader Lost Rs. Bank Nifty Weekly Options. Just Trading June 29, May 12, Options 23 Comments.

Home About Start Here Products Resources Get Inspired Contact.