Black scholes option model formula

The Black Scholes model, also known as the Black-Scholes-Merton model, is a model of price variation over time of financial instruments such as stocks that can, among other things, be used to determine the price of a European call option. The model assumes the price of heavily traded assets follows a geometric Brownian motion with constant drift and volatility.

When applied to a stock option , the model incorporates the constant price variation of the stock, the time value of money , the option's strike price and the time to the option's expiry. It was developed in by Fisher Black, Robert Merton and Myron Scholes and is still widely used in It is regarded as one of the best ways of determining fair prices of options. The Black Scholes model requires five input variables: Additionally, the model assumes stock prices follow a lognormal distribution because asset prices cannot be negative.

Options Pricing: Black-Scholes Model

Moreover, the model assumes there are no transaction costs or taxes; the risk-free interest rate is constant for all maturities; short selling of securities with use of proceeds is permitted; and there are no riskless arbitrage opportunities.

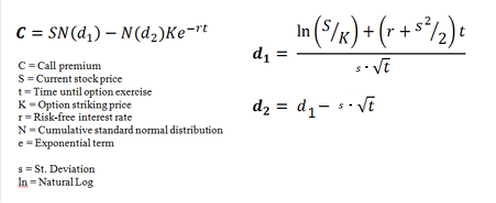

The Black Scholes call option formula is calculated by multiplying the stock price by the cumulative standard normal probability distribution function.

Thereafter, the net present value NPV of the strike price multiplied by the cumulative standard normal distribution is subtracted from the resulting value of the previous calculation. Conversely, the value of a put option could be calculated using the formula: In both formulas, S is the stock price, K is the strike price, r is the risk-free interest rate and T is the time to maturity.

The formula for d1 is: The formula for d2 is: As stated previously, the Black Scholes model is only used to price European options and does not take into account that American options could be exercised before the expiration date.

Moreover, the model assumes dividends and risk-free rates are constant, but this may not be true in reality. The model also assumes volatility remains constant over the option's life, which is not the case because volatility fluctuates with the level of supply and demand. Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Black-Scholes Formula (d1, d2, Call Price, Put Price, Greeks) - Macroption

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Black Scholes Model Share. Scholes Merton Model Stochastic Volatility - SV Robert C. Merton Implied Volatility - IV Model Risk Binomial Option Pricing Model Lattice-Based Model Option Pricing Theory.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.