Butterfly option strategies

Getting Started with Strategies Strategies Advanced Concepts. Why Add Options To Your Practice? Combining two short calls at a middle strike, and one long call each at a lower and upper strike creates a long call butterfly. The upper and lower strikes wings must both be equidistant from the middle strike body , and all the options must have the same expiration date.

Looking for the underlying stock to achieve a specific price target at the expiration of the options. This strategy generally profits if the underlying stock is at the body of the butterfly at expiration. The long call butterfly and long put butterfly , assuming the same strikes and expiration, will have the same payoff at expiration. Long 1 XYZ 65 call. Short 2 XYZ 60 calls.

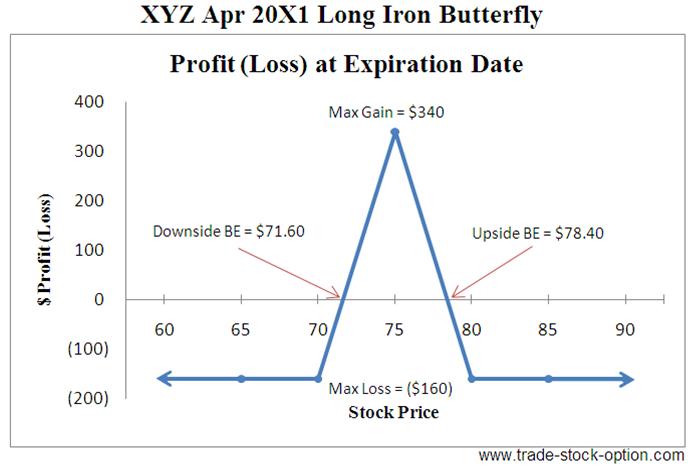

Long 1 XYZ 55 call. However, they may vary in their likelihood of early exercise should the options go into-the-money or the stock pay a dividend. The maximum loss would occur should the underlying stock be outside the wings at expiration. If the stock were below the lower strike all the options would expire worthless; if above the upper strike all the options would be exercised and offset each other for a zero profit.

In either case the premium paid to initiate the position would be lost. The maximum profit would occur should the underlying stock be at the middle strike at expiration. In that case, the long call with the lower strike would be in-the-money and all the other options would expire worthless.

The profit would be the difference between the lower and middle strike the wing and the body , less the premium paid for initiating the position, if any. The potential profit and loss are both very limited. In essence, a butterfly at expiration has a minimum value of zero and a maximum value equal to the distance between either wing and the body.

An investor who buys a butterfly pays a premium somewhere between the minimum and maximum value, and profits if the butterfly's value moves toward the maximum as expiration approaches. The strategy breaks even if at expiration the underlying stock is above the lower strike or below the upper strike by the amount of premium paid to initiate the position. An increase in implied volatility, all other things equal, will usually have a slightly negative impact on this strategy.

The passage of time, all other things equal, will usually have a positive impact on this strategy if the body of the butterfly is at-the-money, and a negative impact if the body is away from the money.

The short calls that form the body of the butterfly are subject to exercise at any time, while the investor decides if and when to exercise the wings. The components of this position form an integral unit, and any early exercise could be disruptive to the strategy.

In general, since the cost of carry makes it optimal to exercise a call option on the last day before expiration, this usually does not pose a problem. But the investor should be wary of using this strategy where dividend situations or tax complications have the potential to intrude. And be aware, a situation where a stock is involved in a restructuring or capitalization event, such as a merger, takeover, spin-off or special dividend, could completely upset typical expectations regarding early exercise of options on the stock.

Long Call Butterfly Spread | Butterfly Spreads - The Options Playbook

This strategy has an extremely high expiration risk. Consider that the maximum profit occurs when at expiration if the stock is trading right at the body of the butterfly. Presumably the investor will choose to exercise their in-the-money wing, but there is no way of knowing for sure whether none, one or both of the calls in the body will be exercised. If the investor guesses wrong, they face the risk of the stock opening sharply higher or lower when trading resumes after the expiration weekend.

This web site discusses exchange-traded options issued by The Options Clearing Corporation. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice.

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, One North Wacker Dr.

Please view our Privacy Policy and our User Agreement. Copyright Adobe, Inc. All Rights Reserved More info available at http: About OIC Help Contact Us Newsroom Welcome! Options Education Program Options Overview Getting Started with Options What is an Option? Program Overview MyPath Assessment Course Catalog Podcasts Videos on Demand Upcoming Seminars.

Options Calculators Collar Calculator Covered Call Calculator Frequently Asked Questions Options Glossary Expiration Calendar Bookstore It's Good to Have Options Video OIC Mobile App Video Series. OIC Advisor Resources Why Add Options To Your Practice? Long Call Calendar Spread. Long Put Calendar Spread. Long Ratio Call Spread. Long Ratio Put Spread.

Short Call Calendar Spread. Short Put Calendar Spread. Short Ratio Call Spread. Short Ratio Put Spread. Description Combining two short calls at a middle strike, and one long call each at a lower and upper strike creates a long call butterfly. Outlook Looking for the underlying stock to achieve a specific price target at the expiration of the options.

Options strategies - Wikipedia

Summary This strategy generally profits if the underlying stock is at the body of the butterfly at expiration. Motivation Profit by correctly predicting the stock price at expiration.

Variations The long call butterfly and long put butterfly , assuming the same strikes and expiration, will have the same payoff at expiration. Max Loss The maximum loss would occur should the underlying stock be outside the wings at expiration. Max Gain The maximum profit would occur should the underlying stock be at the middle strike at expiration. Breakeven The strategy breaks even if at expiration the underlying stock is above the lower strike or below the upper strike by the amount of premium paid to initiate the position.

Volatility An increase in implied volatility, all other things equal, will usually have a slightly negative impact on this strategy. Time Decay The passage of time, all other things equal, will usually have a positive impact on this strategy if the body of the butterfly is at-the-money, and a negative impact if the body is away from the money. Long Put Butterfly Opposite Position: Email Live Chat Email Options Professionals Questions about anything options-related? Email an options professional now.

Chat with Options Professionals Questions about anything options-related?

Chat with an options professional now. REGISTER FOR THE OPTIONS EDUCATION PROGRAM. More Info Register Now. Getting Started Options Education Program Options Overview Getting Started with Options What is an Option? What are the Benefits and Risks? Sign Up for Email Updates. User acknowledges review of the User Agreement and Privacy Policy governing this site. Continued use constitutes acceptance of the terms and conditions stated therein.